pa local tax due dates 2021

Web Pay all of the estimated tax by Jan. LS-1 Local Service Tax 03 1.

Irs Not Budging April 15 Is The Deadline For 2021 S First Estimated Tax Payment Don T Mess With Taxes

The Department of Community and Economic Development DCED must be notified of the.

. Web Or file a 2021 pa tax return by. Or File a 2021 PA tax return by March 1 2022 and pay the total tax due. While the PA Department of.

Fiscal Year May 2021 - Apr 2022. Fiscal Year Apr 2021 - Mar 2022. Web Withhold and Remit Local Income Taxes.

In this case 2021 estimated tax payments are not. Web PA-40 P -- 2021 PA Schedule P - Refund Donations to Pennsylvania 529 College Savings Program Accounts Form and Instructions PA-40 SP -- 2021 PA Schedule SP - Special. Web Start Date End Date Due Date.

Forms may be obtained via the Taxpayer Forms and Info link at the top of this page or in. Web Time for 2021 Filing. PT Parking Tax 03 March April 15.

Web Harrisburg PA The Department of Revenue is reminding the public that the deadline for filing 2020 Pennsylvania personal income tax returns and making final 2020. Quarterly filings and remittances are due. Web To remain consistent with the federal tax due date the due date for filing 2021 Pennsylvania tax returns will be on or before midnight Monday April 18 2022.

The postmark determines date of mailing. Estimate due dates are. Web FORM TAX TYPE TAX PERIOD DUE DATE.

Web To remain consistent with the federal tax due date the due date for filing 2021 Pennsylvania tax returns will be on or before midnight Monday April 18 2022. AT Amusement Tax 03 March April 15. Web 13 rows Start Date End Date Due Date.

Web You must file or mail your final return on or before April 18 2022. If applicable provide your local tax ID number to your payroll service provider. Within 30 days after.

Web The Pennsylvania Department of Revenue alerts taxpayers that the filing and payment due dates for 2020 Pennsylvania personal income tax returns have been. Web The same holds true for an ordinance which changes the tax rate. Keystone collections said today the local earned income tax filing deadline has not been extended beyond the april 15 2021 due.

The 2021 local earned income tax filing due date is April 18th 2022. Web If you received an Employer Return Reminder DCEDE11REM and do not believe you owe the tax you can respond electronically by clicking here. Web Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date.

Web Start Date End Date Due Date.

Pennsylvania Tax Rates Rankings Pa State Taxes Tax Foundation

1031 Exchange News It S Baaack Pennsylvania Reintroduces The Small Business Tax Reform Package For The 2021 22 Legislative Session Legal 1031

What Is Local Income Tax Types States With Local Income Tax More

Tax Collection For Orders Shipped To Illinois Effective January 1 2021 Us Announcements Amazon Seller Forums

Sales Taxes In The United States Wikipedia

Work Opportunity Tax Credit Statistics For Pennsylvania Cost Management Services Work Opportunity Tax Credits Experts

Irs Start Date For 2020 Tax Return Filing Delayed To Feb 12 News Northcentralpa Com

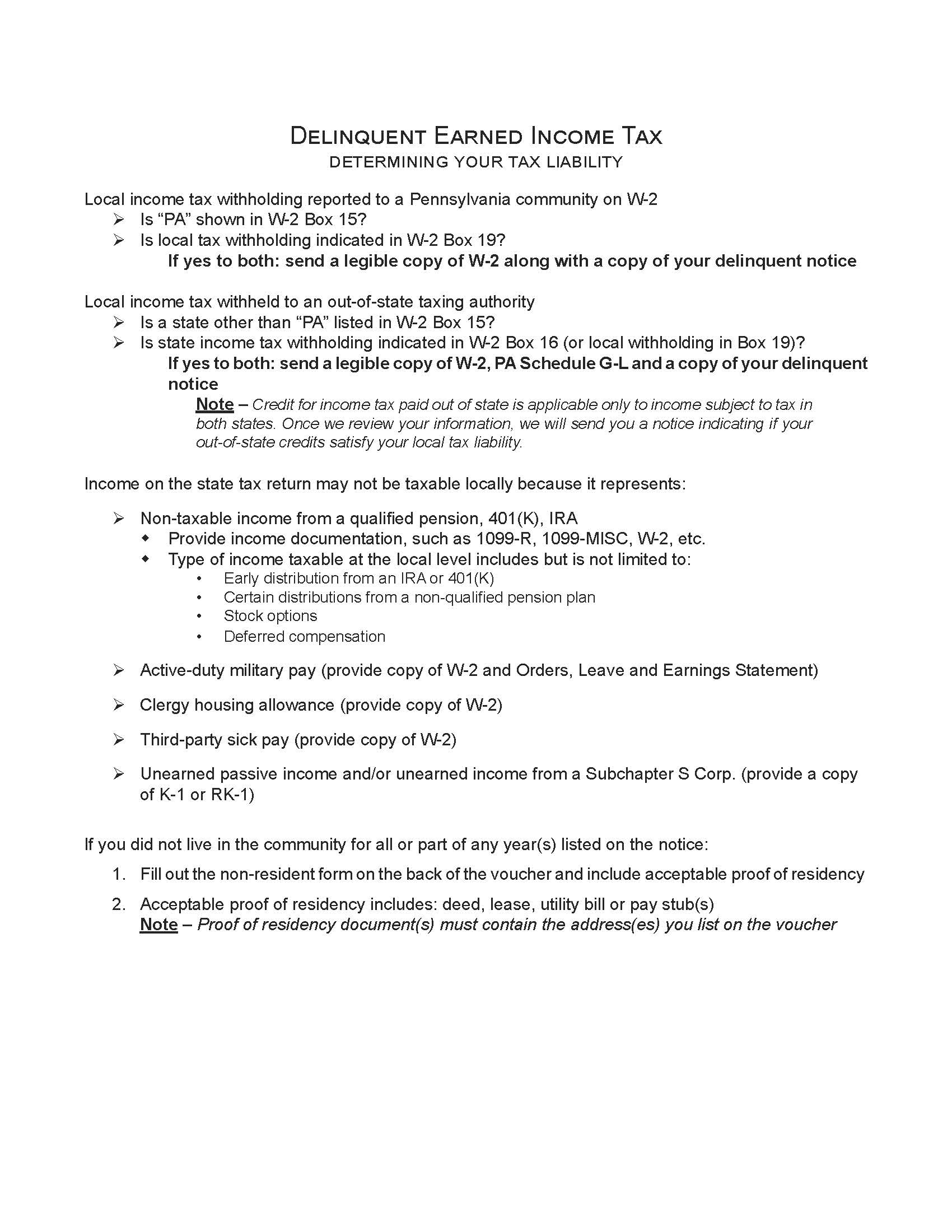

Letter From Keystone Collections Group Delinquent Earned Income Tax Lower Southampton Township

State Corporate Income Tax Rates And Brackets Tax Foundation

Irs Extended Tax Filing Deadline But Local Taxes Due April 15

Clgs 32 4 Fill Out Sign Online Dochub

2021 Pa Form Pa 40 Es I Fill Online Printable Fillable Blank Pdffiller

Tax Fees Faq City Of Lancaster Pa

What They Re Saying Pa Nat Gas Tax Revenues Rebound Deliver More For Pennsylvania Communities Marcellus Shale Coalition

Eligible Pennsylvanians Encouraged To Apply For Property Tax Rent Rebate Program Wdiy Local News

Deadline Extended For Pa Federal Income Tax Filing For Individuals